WooCommerce is a great plugin for starting your own online store cheaply and easily. It comes with many settings so you can fine tune your store to your location of calculating shipping. And there are many options for choosing a payment gateway that uses your currency.

If you are opening an online store in NZ you’ll want to set up the right sales tax, shipping and payment gateway.

New Zealand GST

The NZ government has decided to collect Goods and Services Tax (GST) on all stores selling products in New Zealand. This is a bit of a grey area if you aren’t physically based in New Zealand. If you are based in NZ then collecting and paying GST is a must, unless you want to get in trouble with the tax man.

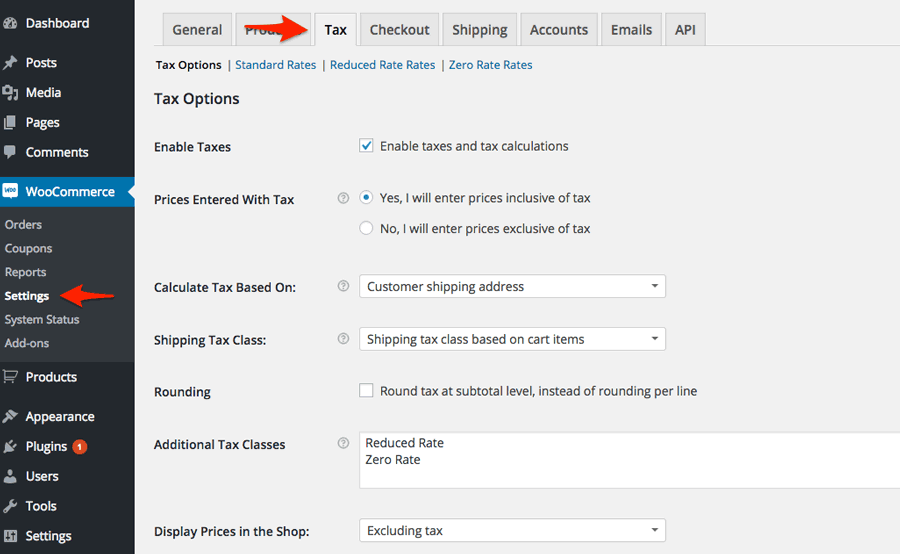

To set up sales tax go to WooCommerce > Settings in the left hand menu. Then click on the Tax tab.

Here you can define tax rates and when taxes are applied.

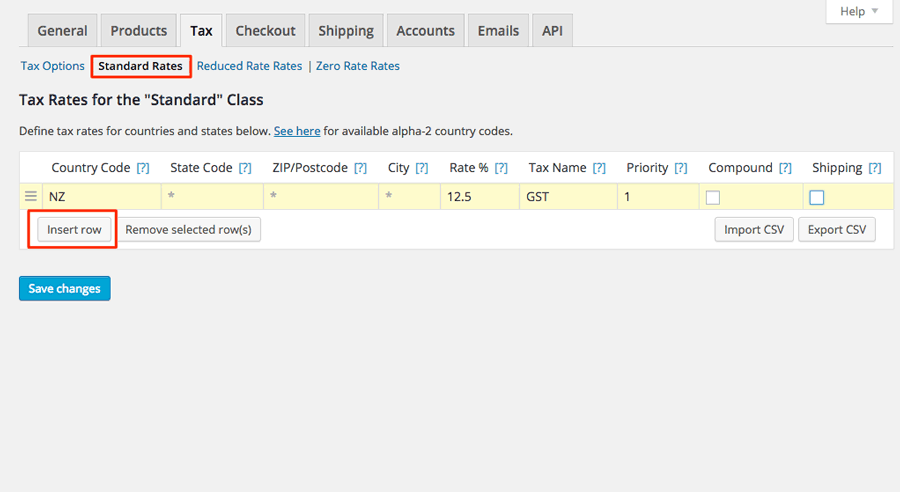

To set up GST click on the blue Standard Rates link under the top tabs.

Then click Insert Row. Here you need to input the country code for New Zealand (NZ).

Leave the rest of the area option blank because it is applied evenly across the country.

Put 12.5 in the rate box.

Give the tax a name – GST

You can choose whether you want to apply GST to the shipping costs. (Probably not if you are using another company to make deliveries)

Thank click the Save Changes button to save the tax.

Now the tax will be applied to customers that are in NZ.

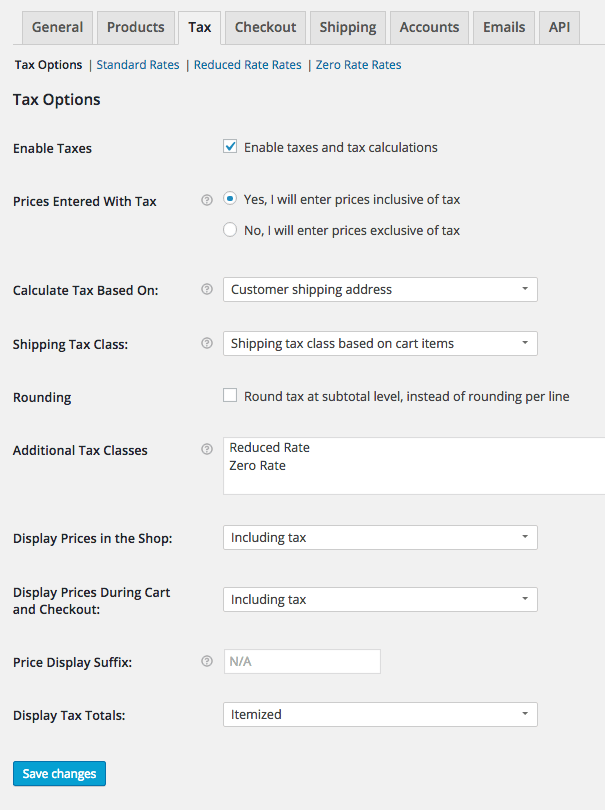

Next go back to the Tax Options screen.

Make sure the Enable taxes and tax calculations check box is ticked

Next you can select whether to enter prices with or without tax when you create a product

You can choose whether to apply GST based on whether the customer’s shipping or billing address is in New Zealand.

You can set rounding if you wish.

Go can display prices GST inclusive or exclusive. In New Zealand most B2B or trade companies will display prices GST exclusive. Because GST can be claimed back. Most retail or B2C companies will display the price including GST.

Then you can choose whether to display the tax amount in the checkout. This is probably a good idea.

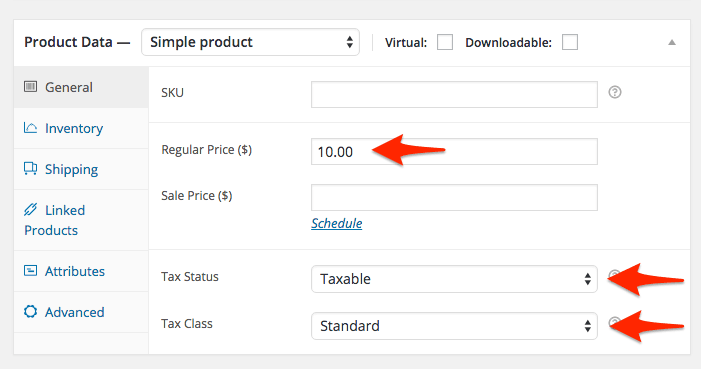

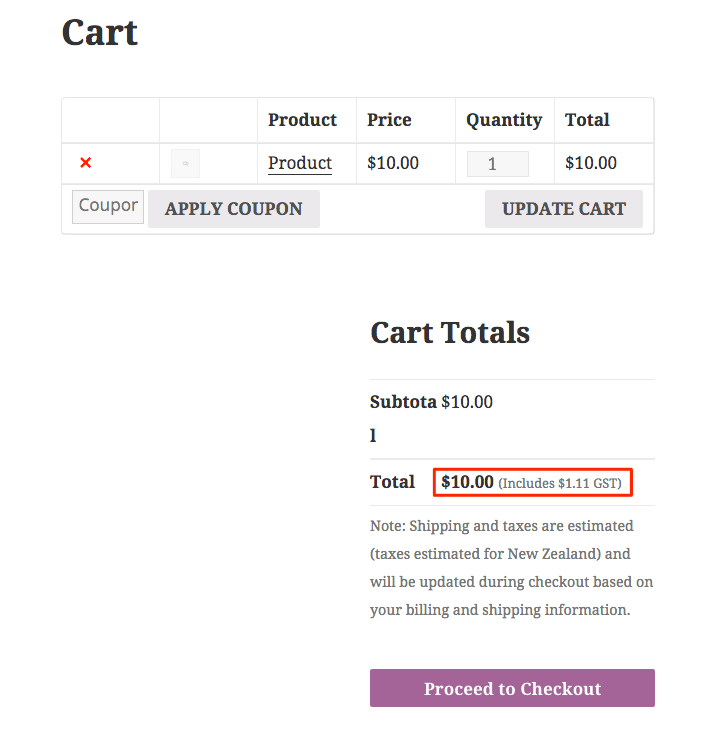

No you can create a product and the right tax amount will be calculated.

Go to Products > Add Product to add a new Product. Scroll down to underneath the main content are and you can see the options area.

Here you can enter your price. To add GST make sure the Tax Status is set to Taxable and the Tax Class is set to Standard.

If we go to the front end of the site and buy the product you can see the GST is calculated correctly.

New Zealand Payment and Credit Card Processing Options

Woo commerce has a few different options for taking payments online.

The built in options are:

- BACS (Bank Transfer)

- Cheque

- Cash on Delivery

- Paypal

To enable each type of payment option, click on the blue link near the top and then check the box to enable the option. For BACS and Cheque you can enter details of which bank account to pay into or who to make the cheque out to. This makes it easier for customers to pay you.

The first three are ok but will prove time consuming if your store becomes a success. Each order and payment will have to be reconciled. WooCommerce has tools for tracking the status of orders and reporting. But still, taking payments online is the best solution.

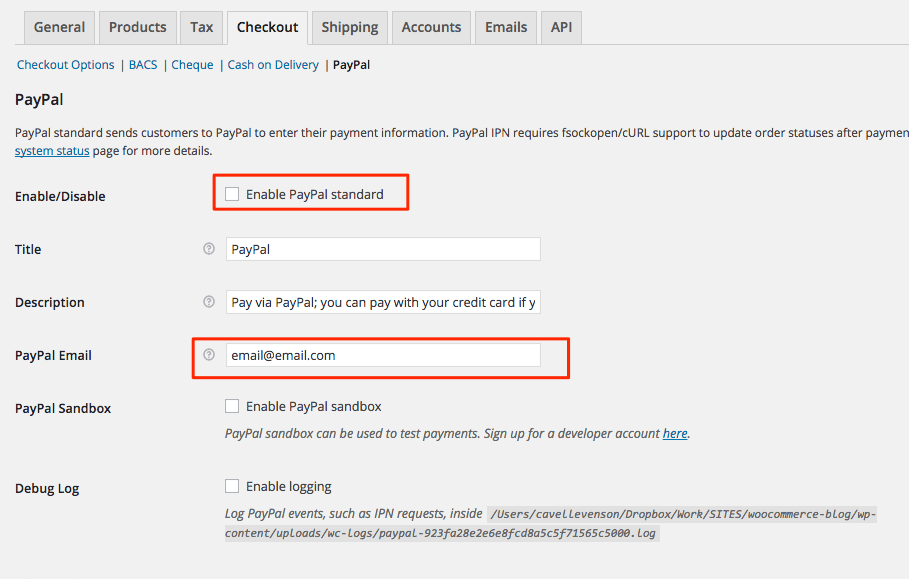

Paypal is the easiest way to get started taking credit card payments. Just set up a PayPal account. Then enter the email address linked to your PayPal account in the area provided in the PayPal section.

TIP: When you sign up for PayPal choose a business account rather than a Personal account. This unlocks the ability for people to pay without a PayPal account and you can use the IPN function.

If you want to use a payment processor that is more close to home you can use a New Zealand payment gateway provider. For example if you bank with ANZ you might want to use ANZ eGate to process payments. Requirements and fees vary so do dome research to find the right solution for your store.

WooCoomerce has many extensions you can purchase to process payments

Payment Gateway Types

There are two types of payment gateways. Hosted and Direct.

Hosted Payments work like PayPal. The customers click the ‘Buy’ Button and are directed away from your website to complete the transaction on the payment gateway’s website. Once the payment has been made you are send back to the store.

This is the easiest way to do it. It requires the least amount of security. No credit card details are ‘sent’ from your store as payment is made on the payment gateway’s servers. However it is slower and can confuse customers who have never been through the process before.

Direct Payments are made ‘on site’. The customer doesn’t get redirected to another web page to make the payment. Although the payment form looks like it is part of the store’s website, usually it is an iFrame placed into your checkout page.

Direct payment is faster and less confusing for customers. The credit card form look like part of your website. However setting up these forms is not as easy as Hosted Payment. Sometime they need a web developer to implement. You will need a SSL certificate to encrypt the data being sent. You may have to make your website PCI compliant.

For first time store owners I would recommend a Hosted Payment solution. You can always upgrade once your website grows.

New Zealand Shipping Options

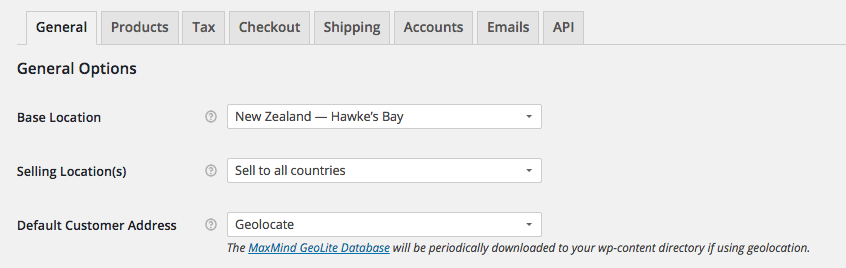

To use the shipping calculator, first you should set up your store location and the countries you want to sell to.

Go the the ‘General’ tab on the settings page. Here you can set the base location, the countries you want to sell to and whether you want Geolocation to find you customers address.

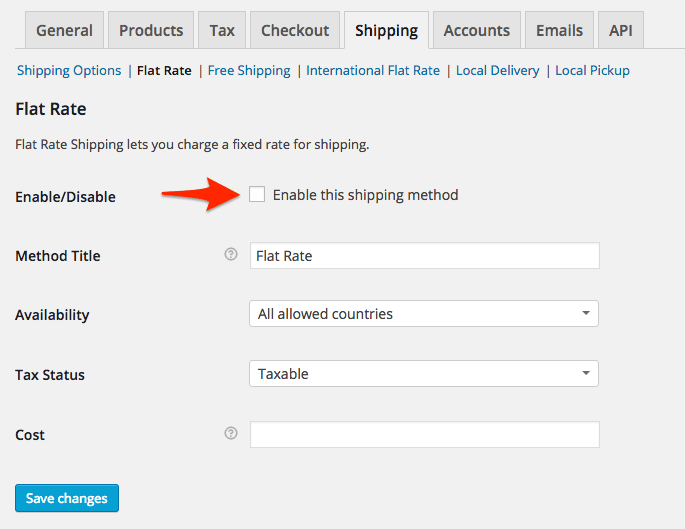

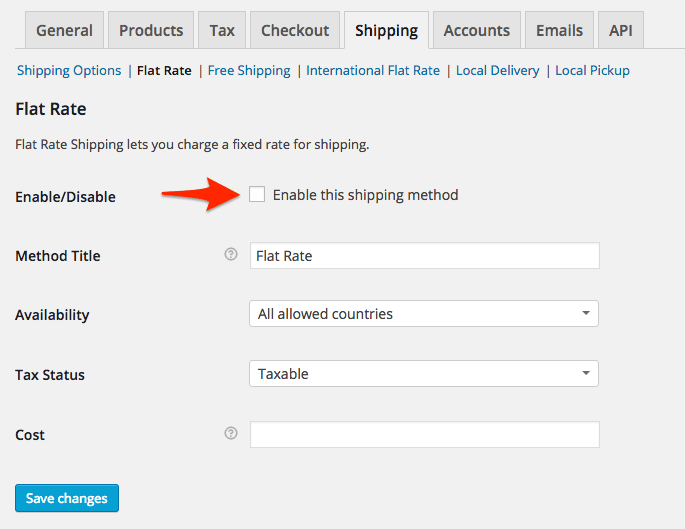

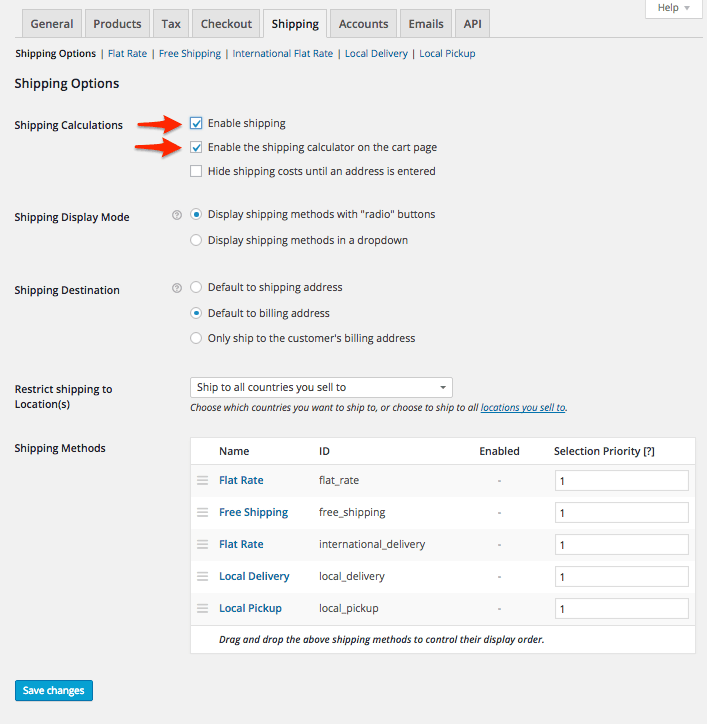

To enable shipping go to the ‘Shipping’ tab. Here you can see the overview of the shipping options. Similar to the payment options, you can click the blue link under the tabs. On each type of shipping’s page you need to enable it by ticking the Enable checkbox.

You can input the cost to the customer and whether you want to charge tax on top of the shipping cost.You can also choose the countries that each shipping type applies to.

The price calculation is a rough fit so you just need to find a price that will cover your costs.

There are more advanced ways for calculating shipping rates. There are WooCommerce extension plugins that will fetch the current postage and add it to your shipping cost.

New Zealand Post

The NZ Post extension will get the current postage rates direct from New Zealand Post via their API. You can change the name of the services and define weight and size parameters.

Domestic

- ParcelPost

- ParcelPost Fast

- ParcelPost Tracked

- Courier

International

- International Express Courier

- International Economy Courier

- International Air

- International Economy

Fastway Couriers

Likewise, Fastway Couriers have an extension plugin that will get the current shipping price via their API

Shipit

Shipit is more of a fulfilment service that will take care of delivery for you. You just need to pack and print the label. Ship uses DHL, Aus Post, Fastway, Couriers Please, Courier Post, NZ Post and many more to automate your fulfilment process. Shipit specialise in serving NZ and Australia and have phone support in both countries.

That concludes this post on setting up your WooCommerce store in New Zealand. Stay tuned for more in depth posts on how to use WooCommerce in future.

FREE VIDEO TRAININGHow to increase sales and profit for your WooCommerce store

A simple 5 step plan to increase sales and profit for your WooCommerce store without wasting money on ads